DOE Report on a Hydrogen Economy

The Energy Policy Act of 2005 required a massive Study on the effect that the transition to the Hyrdogen Economy was going to have on our overall economy. This is becasue the technolgies were already commecrailly vaiable, and would change the way we do everything from how we use power in fixed sites to how we drive.

The study, The Effects of a Transition to a Hyrdogen Economy on Employment in the United States. was published in July 2008 and presented to Congress.

They Examined:

• Replacement effects of new goods and services

• International competition

• Workforce training requirements

• Multiple possible fuel cycles, including usage of raw materials

• Rates of market penetration of technologies

• Regional variations based on geography

• Specific recommendations of the study

Note: do not be daunted by the dates - T Boon Pickins Media Campaign and the Gas prices, coupled with the new Energy bill, the auto manufacturing crisis, and the need for an economic shift will sigificantly accelerate the transition.

- The study estimated the employment impacts of a transformation of the U.S. economy to the use of hydrogen between 2020 and 2050.

- They considered a rapid scenario and a slow scenario, but the conclusion is that the economy is already in transition, and will be transformed by 2050.

Onsite Hyrdrogen Power Generation or (Onsite Renewable Energy Generation or OREG

- fuel cells initially provide power, including back-up power, for remote locations not easily served by the electric power transmission and distribution grid.

- Following success in these markets, fuel cells begin to penetrate markets for

portable power, then markets for all types of distributed power. - For back-up and remote power markets, users are willing to pay a premium for secure, reliable electricity. Such markets include hospitals, hotels, data centers, and computer facilities, where uninterrupted

power is critical. - While these initial markets provide the sales volumes to launch the industry,

the fuel cells themselves operate relatively few hours per year and displace little grid

electricity.

Portable Power

- Portable power is a likely follow-on market for fuel cells.

- Fuel cells are being eyed for a wide array of portable applications ranging from consumer electronics to small-scale power production.

- Portable electronics (e.g., cell phones and notebook computers) utilizing

premium lithium-ion and nickel metal-hydride batteries are particularly promising candidates for substitution by fuel cells. - Premium batteries are popular because of their high energy

density. - As portable devices become more complex and their power requirements increase,

fuel cells become an increasingly promising alternative. - Since 2002, the number of devices containing premium batteries that the average American carries has grown 10% annually, to 0.5 devices per person.18 As the variety and functionality of portable consumer electronics grow, each person will carry increasingly multi-functional devices.

- While this will increase the demand for portable power, it may not increase the total

number of devices beyond some natural limit of perhaps 1 device per person on average. - Assuming the base-case population forecast of 420 million, some 400 million portable fuel

cells could be in use in 2050.

Power Grid Displacement

- As fuel cells penetrate the portable power market and enter the broad residential and

commercial power market, electricity displacement becomes substantial. - Like fuel cells for mobile applications, stationary fuel cells are assumed to meet program cost and performance targets.

- In this study, stationary fuel cells are assumed to be natural gas fueled, where the fuel

cell system includes an integrated reformer to produce the hydrogen - Stationary Fuel Cells in the HFI Scenario

In the HFI Scenario, stationary fuel cells are assumed to achieve 1% penetration of “new”

electric demand in 2020, 5% in 2035, and 10% in 2050.19 - “New” demand is defined as the difference between electricity demand in 2015 and the analysis year (2020, 2035 or 2050), and is meant to include a variety of markets – back-up power, portable power and the broader market for residential and commercial power – which increasingly shift to fuel cells.

Penetration by fuel cells results in displacement of 0.01 quad of grid electricity in 2020, 0.3 quads in 2035, and slightly over 1 quad in 2050.

Here is an executive Summary:

- The Technology is "fairly mature" now

- Natural gas is NOT expected to be along term Feedstock for Fule cells.

- All Hyrdogen will be produced Locally, and will NOT be an international Commodity

- They expect a $370 Billion ( yes Billion) dollar PER YEAR drop in money going overseas by 2050.

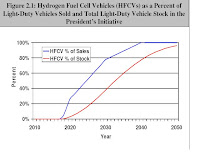

- They anticipate fully fuel celled vehcilpes available by 2018 followed by a rapid replacement of the light-duty vehicle market

- All light duty vehciles are replaced by 2050

- They anticipate that fule infrastructure will be insltalled in "lock step" with vehicle demand growth.

Fuel Production

- Initially, most hydrogen is produced on-site, in relatively small, “distributed” facilities or

delivered to fueling stations from existing, large industrial plants. - Distributed facilities are more costly to build and maintain than gas stations.

- As demand for hydrogen rises, fuel production shifts to centralized facilities that can

better capture economies of scale - Regionalized resources will dictate Hyrdogen development methodology. Regions with nearby coal suppliesand CO2 sequestration sites opt for more coal gasification while those with ample wind or biomass favor hydrogen production technologies that rely more on those resources.

From centralized production facilities, hydrogen is delivered to local fuel stations where it is

dispensed along with conventional motor fuels.

As demand increases, delivery technologies shift from primarily tanker trucks carrying cryogenic liquid hydrogen to a mix of trucks carrying cold compressed hydrogen in insulated high-pressure tanks, and, beginning between 2020 and 2035, gas pipelines.

By 2050, when hydrogen has replaced nearly all motor gasoline, most local fuel stations no longer dispense gasoline.

Storage

- The development of an on-board hydrogen storage technology for hydrogen-powered

vehicles has implications for the hydrogen delivery infrastructure. - Currently, compressed hydrogen storage is the dominant approach for on-board hydrogen storage, with most systems using 5,000 psi composite tanks.

- Next generation systems, which have started to appear in demonstrations use higher pressure 10,000 psi tanks.

International Impacts

- With Falling OPEC Incomes, OPEC purchases inthe US will be reduced

- Their leanding to Industrialized Countries will be reduced.

Read the Whole Report from at fuelcells.org

Comments

Post a Comment